For years, managing multiple bank accounts meant a constant juggle, requiring users to hop between apps, individually check balances, and then manually tally up their total funds. This common financial frustration is now a thing of the past, thanks to a groundbreaking feature from Paytm. India’s pioneering payments and financial services distribution company has introduced a “Total Balance Check” for UPI-linked bank accounts, providing users with a real-time, consolidated view of their money across all their linked accounts. This significant update is poised to transform how millions of Indians interact with their finances daily, offering clarity and unprecedented ease.

Key Takeaways:

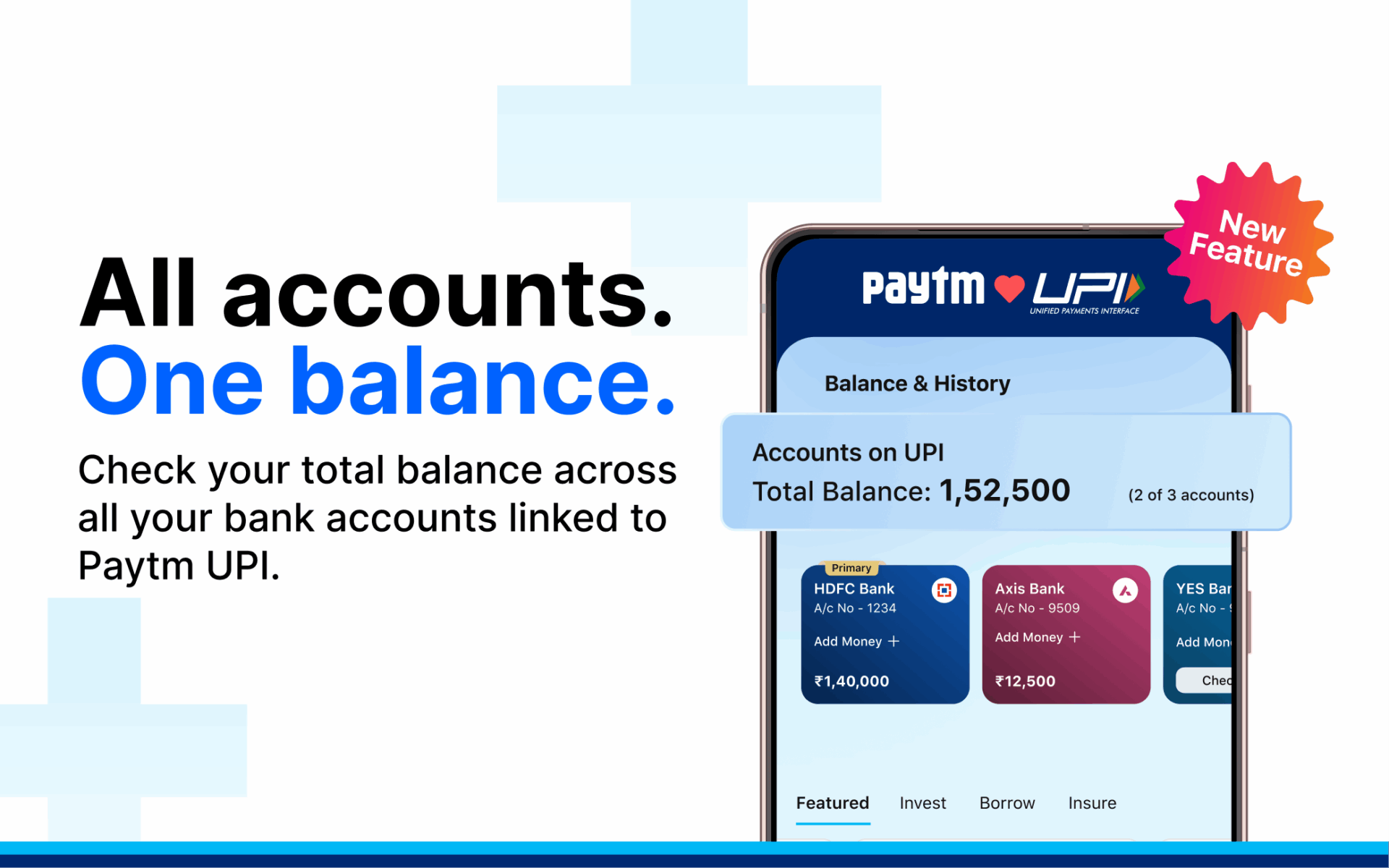

- Paytm’s new “Total Balance Check” feature provides a consolidated view of all UPI-linked bank account balances.

- Users no longer need to manually add up balances from multiple bank accounts.

- The feature displays both individual account balances and a real-time total after UPI PIN verification.

- Access the feature via the “Balance & History” section in the Paytm app.

- This builds on Paytm’s history of introducing user-centric innovations in mobile payments.

The Dawn of a Unified Financial View The challenge of scattered financial information is a familiar one for many. Individuals often hold multiple bank accounts—one for salary, another for savings, and perhaps a third for daily expenses. Keeping track of the exact funds across all these accounts has historically been a tedious exercise. Before this new feature, a Paytm user would need to navigate to each linked bank account within the app, initiate a balance inquiry, enter their UPI PIN, and then mentally (or physically) add the amounts together to ascertain their overall financial standing. This fragmented approach not only consumed valuable time but also hindered a clear understanding of one’s total available funds.

Paytm’s new “Total Balance Check” addresses this pain point directly. By simply accessing the feature, users can now securely fetch individual bank balances, verify them with their UPI PIN, and instantly see a dynamically calculated total balance displayed upfront on their screen. This streamlines the process, making fund management simpler, faster, and far more intuitive. It’s particularly valuable for those who manage diverse financial portfolios and often lose visibility into their aggregate finances due to the sheer number of accounts.

A Paytm Spokesperson articulated the company’s vision behind this move, stating, “We believe in simplifying financial management through continuous focus on improving our offerings. With Total Balance View, users who have linked multiple bank accounts for UPI on the Paytm app can effortlessly check both total and individual bank balances. This makes it easier to track expenses, plan spends, manage savings, and make informed financial decisions.” This statement highlights Paytm’s commitment to empowering users with better tools for financial literacy and control.

How to Unlock Your Consolidated Balance Accessing this convenient new feature is straightforward for Paytm users:

- Open the Paytm app: Launch the application on your mobile device.

- Navigate to “Balance & History”: This section is the central hub for all your transaction records and account details.

- Link UPI-enabled bank accounts: If you haven’t already, ensure all your desired bank accounts are linked to UPI on your Paytm app.

- Check individual account balances: For each linked account, initiate a balance check and enter your secure UPI PIN.

- View your total balance: Once individual balances are checked and verified, the app will dynamically sum them up and display the total balance of all linked accounts at the top of the screen. This total updates every time a balance is checked for any of the linked accounts.

This step-by-step process ensures user security by requiring UPI PIN verification for each account, maintaining the integrity of financial data while providing the convenience of a consolidated view.

The UPI Phenomenon and Paytm’s Role The Unified Payments Interface (UPI), developed by the National Payments Corporation of India (NPCI) and launched in 2016, has fundamentally changed India’s digital payment landscape. It allows for instant, inter-bank peer-to-peer (P2P) and person-to-merchant (P2M) transactions, making financial transfers as simple as sending a text message. UPI operates on a robust four-pillar push-pull interoperable model, where various Payment Service Providers (PSPs) and banks collaborate to settle transactions seamlessly.

NPCI, formed in 2009 under the guidance of the Reserve Bank of India (RBI), was tasked with integrating and standardizing India’s retail payment mechanisms. UPI emerged as a cornerstone of this effort, providing a secure, efficient, and interoperable system. Its success has been immense, propelling India to become the world’s largest real-time payment market. The ability to link multiple bank accounts to a single UPI application, a feature inherent to UPI’s design, has been a key driver of its widespread adoption. This interoperability has significantly reduced the reliance on multiple banking platforms, offering users greater flexibility and control over their finances. Paytm, as one of the earliest adopters and a significant player in the UPI ecosystem, has consistently built upon this foundation, introducing features that enhance user experience and simplify digital transactions.

Beyond Total Balance: Paytm’s String of User-Centric Innovations Paytm’s “Total Balance Check” feature is not an isolated development; rather, it’s the latest in a series of thoughtful innovations aimed at making mobile payments more secure, private, and efficient. The company has a demonstrated history of listening to user feedback and introducing functionalities that cater to evolving needs.

One notable example is the ability to hide or unhide specific payments for added privacy. This feature addresses concerns about sensitive transactions appearing in a user’s payment history, allowing individuals to discreetly manage their records while ensuring all transactions remain securely accessible when needed. This level of control over personal financial data is a significant step towards greater user empowerment.

For quicker transactions, Paytm has also rolled out home screen widgets like ‘Receive Money’. These widgets provide instant access to frequently used functions, reducing the number of taps required to complete a transaction and further streamlining the payment process. Such small but impactful design choices contribute significantly to overall user convenience.

Recognizing the desire for greater privacy, Paytm introduced personalised UPI IDs. This feature allows users to create unique and easy-to-remember handles, such as name@ptyes or name@ptaxis, while keeping their mobile numbers private during transactions. This move enhances security and provides users with a more customized and private payment experience.

For comprehensive record-keeping, Paytm offers the option to download UPI statements in Excel or PDF formats. This functionality is invaluable for budgeting, tax purposes, or simply maintaining a detailed overview of spending patterns, providing users with actionable insights into their financial behavior.

Furthermore, Paytm has expanded the reach of mobile payments beyond India’s borders. The company now supports UPI transactions in countries such as the UAE, Singapore, France, Mauritius, Bhutan, Sri Lanka, and Nepal. This international expansion makes payments more seamless for Indian travelers abroad, fostering global financial connectivity and extending the convenience of UPI to new geographies. This ongoing effort to expand UPI’s international footprint, supported by NPCI International Payments Limited (NIPL), demonstrates a commitment to making UPI a truly global payment method, benefiting millions of Indian diaspora and tourists.

Security at the Core of UPI The ease and speed of UPI transactions are complemented by robust security measures. The system employs multi-layered authentication, with the UPI PIN being a critical component, ensuring that only the authorized user can complete payments. Even if a mobile device is lost or stolen, transactions cannot proceed without the correct UPI PIN. This is further bolstered by end-to-end encryption protocols like Advanced Encryption Standard (AES) and Transport Layer Security (TLS), which safeguard sensitive information during transit. Regular bank verification, fraud management tools, and adherence to strict regulatory compliance standards set by NPCI and RBI further fortify the security framework of UPI, instilling trust and confidence in users. The overall design prioritizes user safety and data privacy, making digital transactions reliable and secure.

The Future of Financial Management Paytm’s latest innovation is a clear indicator of the evolving landscape of digital finance in India. As more individuals embrace digital payments and manage multiple financial avenues, the demand for consolidated, easy-to-understand financial views will only grow. The “Total Balance Check” feature represents a significant leap in meeting this demand, providing users with a comprehensive snapshot of their UPI-linked funds.

This move aligns with the broader trend towards open banking and financial aggregation, where users gain greater control and visibility over their diverse financial accounts through a single interface. By simplifying the overview of funds across different banks, Paytm is not just offering a convenience; it is contributing to greater financial literacy and empowering users to make more informed decisions about their savings, spending, and financial planning. The relentless pursuit of user-centric solutions, coupled with the underlying strength of the UPI framework, positions Paytm to continue driving the digital payment revolution in India and beyond.

Frequently Asked Questions (FAQs)

Q1: What exactly is the “Total Balance Check” feature on Paytm?

A1: The “Total Balance Check” feature on the Paytm app allows users to see the combined total of their balances across all bank accounts that are linked to UPI on the Paytm platform. It also displays individual account balances.

Q2: How does this feature make managing multiple bank accounts easier?

A2: Previously, you had to open each bank account separately on the app, check its balance, and then manually add them up. With this feature, after verifying your UPI PIN for each account, Paytm automatically calculates and displays the total balance instantly, saving time and effort.

Q3: Is my financial information secure when using this feature?

A3: Yes, the feature securely fetches individual bank balances only after UPI PIN verification for each account. UPI transactions are protected by multi-layered security measures, including UPI PIN authentication and encryption, ensuring your financial data remains safe.

Q4: Which bank accounts can be included in the Total Balance Check?

A4: Any bank account that you have successfully linked for UPI transactions on your Paytm app can be included in the Total Balance Check.

Q5: Do I need to re-enter my UPI PIN every time I want to see the total balance?

A5: Yes, to ensure security and authenticate the balance inquiry for each linked account, you will need to enter your UPI PIN when checking the individual balances. The total balance is then dynamically calculated and displayed.

Q6: Can I see a breakdown of balances for each individual bank account?

A6: Yes, in addition to the total consolidated balance, the feature also displays the individual balances for each of your UPI-linked bank accounts.

Q7: What other privacy features has Paytm introduced for mobile payments?

A7: Paytm has introduced features like the ability to hide or unhide specific transactions from your payment history, and personalized UPI IDs that allow you to transact without revealing your mobile number.

Q8: Can I use Paytm UPI for international transactions? In which countries?

A8: Yes, Paytm supports UPI transactions for Indian travelers in several countries, including the UAE, Singapore, France, Mauritius, Bhutan, Sri Lanka, and Nepal.

Q9: Who developed UPI and what is its significance in India?

A9: The Unified Payments Interface (UPI) was developed by the National Payments Corporation of India (NPCI). It’s a real-time payment system that has revolutionized digital transactions in India, allowing for instant money transfers between bank accounts using a mobile phone.