Kotak Mahindra Prime Limited (KMPL), the auto finance arm of the Kotak Group, has now become a preferred financier for Tesla electric vehicles in India. For Indian buyers interested in Tesla’s high-tech EVs, this partnership means access to custom-tailored financing plans, easing the path to ownership. Interestingly, KMPL is the first financial institution in the country to secure this preferred status with Tesla.

Key Takeaways:

- Kotak Mahindra Prime is now a preferred financier for Tesla EVs in India.

- The partnership offers custom financing schemes for Tesla buyers.

- Buyers can check financing options directly on Tesla’s India portal and mobile application.

- This collaboration supports the growth of sustainable mobility solutions in India.

With this collaboration, buyers will be able to explore financing options from Kotak Mahindra Prime right through Tesla’s India portal and mobile app. The goal is to create a more seamless and convenient buying experience. And the timing feels intentional, Tesla’s official entry into India is finally happening, marked by the launch of its Model Y SUV and the unveiling of its first showroom in Mumbai.

Shahrukh Todiwala, Managing Director and CEO of Kotak Mahindra Prime, commented that the company has consistently backed sustainable mobility. He believes this new step with Tesla will help more customers take part in a more eco-conscious way of life. Tesla’s debut in India does feel like a milestone, especially as the country pushes further toward cleaner, greener transport solutions.

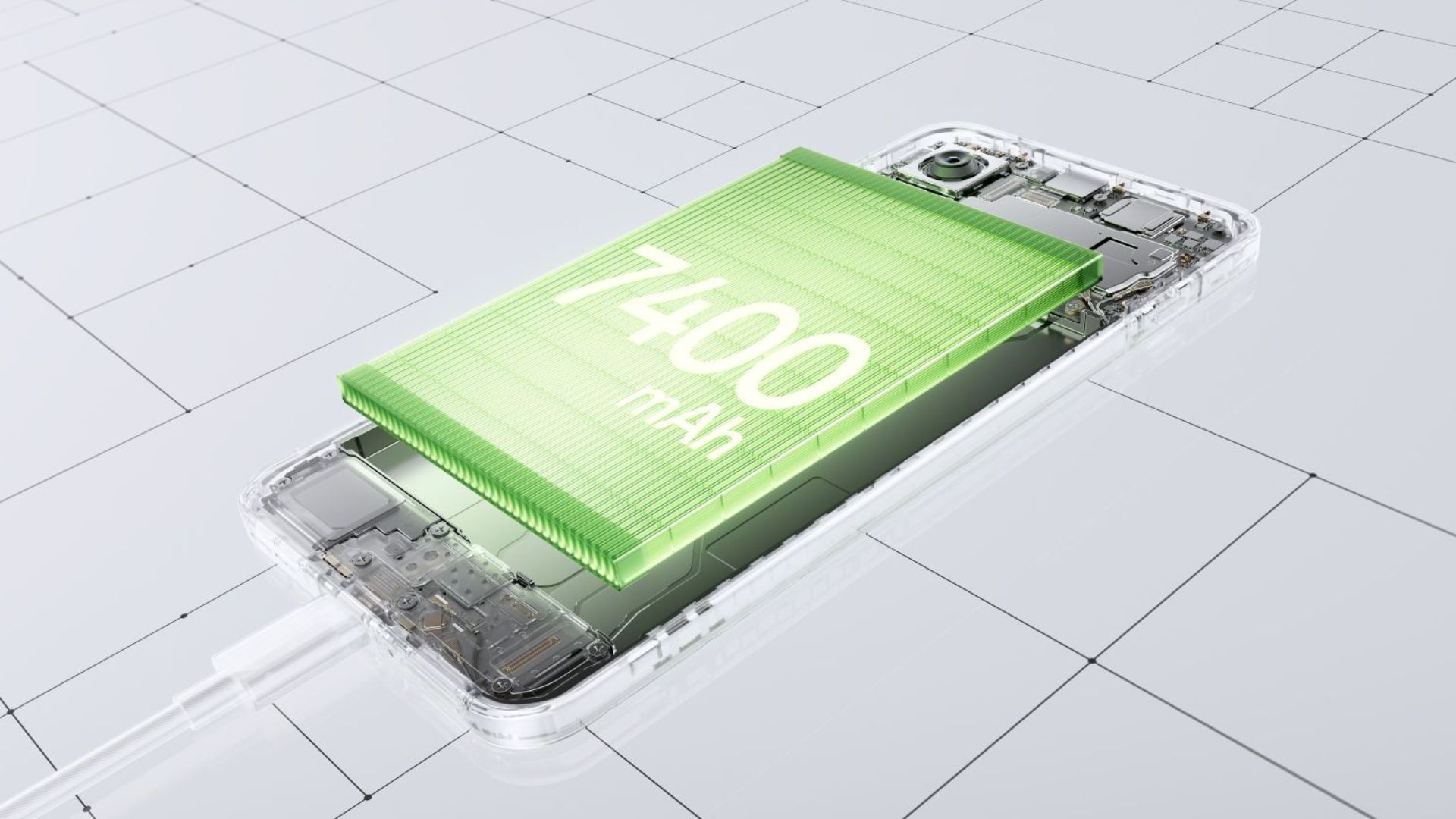

As for the product itself, Tesla has introduced the Model Y as its opening act. Available in two variants, Standard and Long Range, it starts at about Rs 59.89 lakh (ex-showroom). These are Completely Built Units (CBUs), which explains the higher price tag due to the steep import duties India still imposes on fully imported vehicles.

The broader EV landscape in India is evolving fast. Sales of electric cars are expected to climb rapidly over the next few years. That’s thanks to a combination of more model choices, growing charging infrastructure, and government incentives, such as the production-linked incentive (PLI) scheme focused on battery manufacturing. The rollout of public charging stations has also picked up pace, making it a bit easier for drivers to consider the switch to electric.

Kotak Mahindra Prime itself has been in the auto financing game since 1996 and is a wholly owned subsidiary of Kotak Mahindra Bank Limited. It handles financing for both new and pre-owned vehicles, including two-wheelers, and provides wholesale finance to dealerships and loans against property. With 161 branches spread across 24 states in India, it has long-standing ties with many of the country’s top auto manufacturers.

This latest move is expected to boost access to Tesla EVs by offering structured finance options tailored to Indian consumers. In a way, it also signals how seriously the Indian market is beginning to take electric vehicles, not just in policy, but in actual consumer-level investment.

Related FAQs:

Q1: Which Tesla models are available for purchase in India?

A1: Currently, the Tesla Model Y SUV is available for purchase in India.

Q2: How can I check financing options from Kotak Mahindra Prime for a Tesla EV?

A2: You can check the financing options directly on the official Tesla India portal or their mobile application.

Q3: What are the typical loan tenures offered by Kotak Mahindra Prime for car loans?

A3: Kotak Mahindra Prime typically offers flexible repayment tenures ranging from 12 to 84 months for car loans.

Q4: Will Tesla set up manufacturing facilities in India?

A4: Tesla is currently importing cars to India and has not yet committed to setting up a manufacturing plant in the country. They are evaluating the market before making larger investments.

Q5: What are the general criteria for availing a car loan from Kotak Mahindra Prime?

A5: Eligibility typically includes minimum age requirements for salaried and self-employed individuals, a minimum monthly income, and submission of necessary documents like salary slips, IT returns, and proof of residence. Specific terms and conditions apply.