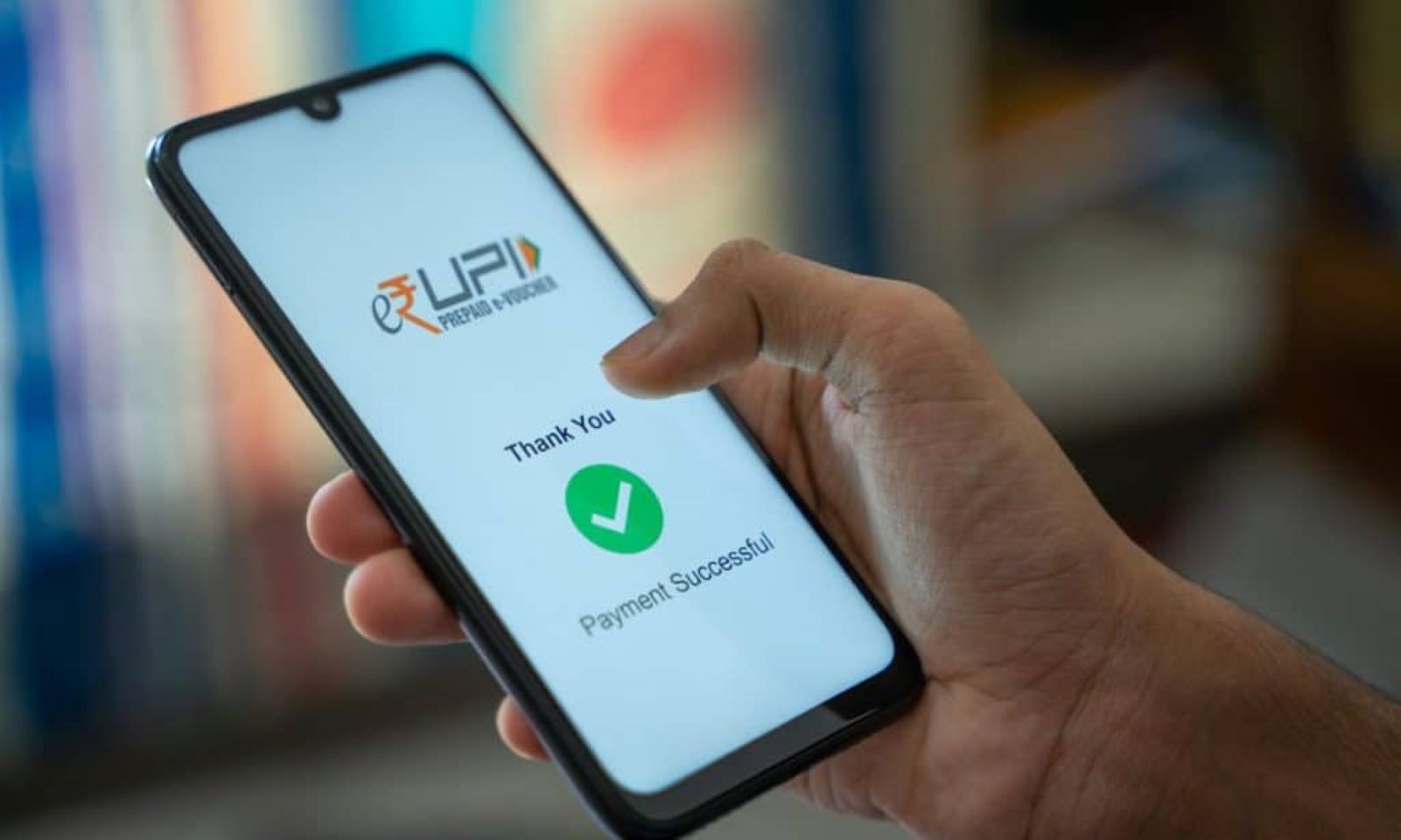

The National Payments Corporation of India (NPCI), the organisation behind the Unified Payments Interface (UPI), has introduced two new ways to authorise transactions: biometric verification and payments through wearable smart glasses. This move could significantly change how millions of Indians make digital payments, giving them more choices beyond the traditional UPI PIN. Now, users can verify a payment with their fingerprint or an iris scan directly on their smartphones or even approve it hands-free using supported smart glasses.

Key Takeaways

- NPCI has rolled out biometric and smart glass payment options for UPI.

- The biometric feature uses a phone’s fingerprint sensor or front camera for iris scans to approve payments.

- The wearable glass feature allows users to scan a QR code and authorise payments using eye gestures or voice commands.

- These features aim to make transactions faster and more secure.

The new biometric system works seamlessly with hardware already present in most modern smartphones. When making a UPI payment, users will now be able to authenticate using their fingerprint or an iris scan instead of entering a 4 or 6-digit PIN. It’s not just quicker but also more discreet, reducing the risk of someone watching as a PIN is typed in. UPI, India’s leading real-time payment system, has always been about simplicity and accessibility, and this update takes that a step further, especially for those who might struggle to remember PINs.

The second feature opens up an entirely new way of using UPI through wearable technology. With compatible smart glasses, a user can simply look at a merchant’s QR code. The built-in camera in the glasses scans it, and the payment details appear on a small screen within the user’s field of vision. From there, the user can confirm the payment with a voice command or even a subtle eye movement. It’s quick, hands-free, and feels a bit futuristic, though perhaps still in its early days for everyday use.

According to NPCI, both these features were developed after extensive testing to ensure they meet UPI’s established security standards. The rollout will be gradual, with several major banks expected to update their UPI apps to include the new authentication options over the coming weeks.

Established in 2008, the National Payments Corporation of India has been the backbone of India’s digital payments ecosystem, powering platforms like RuPay, IMPS, and Bharat Bill Pay. With these latest advancements, NPCI is once again showing its intent to push boundaries and make digital transactions smoother, safer, and perhaps even a little more futuristic.

Frequently Asked Questions (FAQs)

Q. Is biometric authentication for UPI safe?

A. Yes, it is considered very safe. Biometric data like your fingerprint or iris is unique to you and is stored securely on your device. The transaction is encrypted, just like PIN-based payments.

Q. How do I start using these new UPI features?

A. You will need to update your bank’s or third-party UPI app once they release the version supporting these features. After the update, you can enable biometric or wearable authentication in the app’s settings section.

Q. Which smart glasses will work with UPI?

A. NPCI is collaborating with several smart glass manufacturers. A specific list of compatible devices will be announced by the corporation and the device makers soon.

Q. Will I still need to remember my UPI PIN?

A. While you can use biometrics or glasses for most transactions, your UPI PIN will still be required for setting up these new features and as a backup authentication method. You will also need it for certain high-value transactions or if the biometric scan fails.