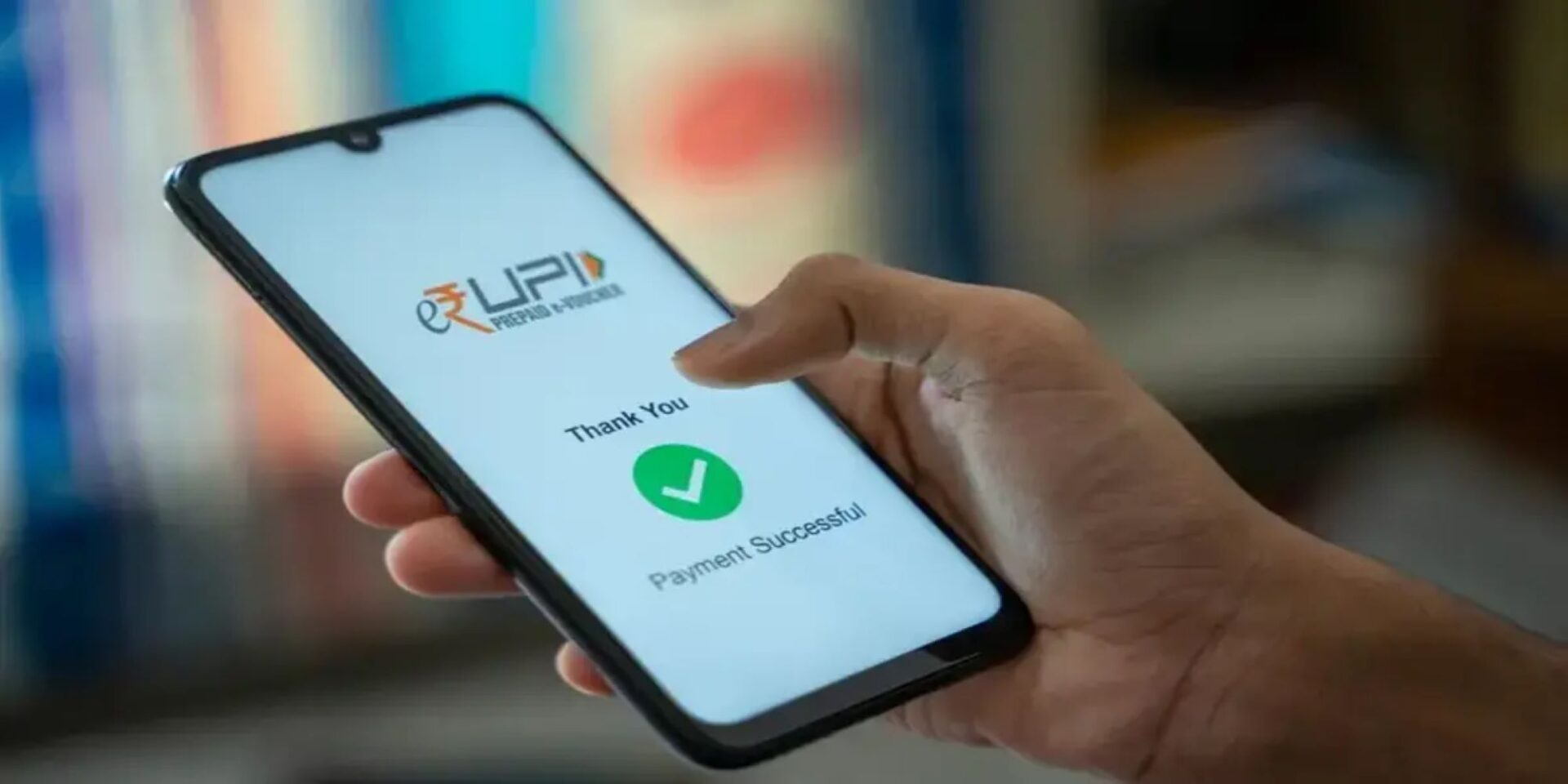

In a significant update for Unified Payments Interface (UPI) users, the National Payments Corporation of India (NPCI) has increased the per-transaction limit to ₹10 lakh, but only for a few specific types of payments. The change will take effect from September 15, 2025, and is aimed at making high-value digital transactions easier, particularly for investors and those managing large credit card bills.

Key Takeaways

- New Transaction Limit: A single UPI payment of up to ₹10 lakh is now allowed in select categories.

- Where It Applies: IPO subscriptions, purchase of securities in the secondary market, and credit card bill payments above ₹1 lakh.

- Effective Date: September 15, 2025.

- Everyday Payments Unchanged: The usual UPI cap of ₹1 lakh per transaction, and daily limit, stays the same for most payments, depending on your bank’s policies.

This decision follows a directive from the Reserve Bank of India (RBI), which has been pushing to expand digital payments into areas traditionally dominated by banking channels like NEFT or RTGS. Since its launch, UPI has grown into India’s most widely used payment system, handling everything from daily shopping to big-ticket transactions. The higher cap, therefore, feels like a natural next step as people increasingly rely on UPI for just about everything.

Interestingly, this isn’t the first time the transaction ceiling has been revised upward. Earlier, the limit for IPO applications and the RBI’s Retail Direct Scheme was capped at ₹5 lakh. By doubling that to ₹10 lakh, NPCI is essentially giving retail investors more room to participate in capital markets. For example, someone applying for a larger share allotment during an IPO or purchasing government or corporate bonds can now complete the transaction instantly in just one go.

For credit card users too, this is a welcome change. Until now, anyone with a bill of more than ₹5 lakh often had to split it across multiple UPI payments or resort to other banking methods. With the new limit, a single UPI transaction can clear bills up to ₹10 lakh, which should save a fair bit of time and hassle.

That said, the higher cap doesn’t apply across the board. For everyday payments, whether you’re paying a shopkeeper, transferring money to a friend, or settling your monthly utilities, the standard limit of ₹1 lakh still applies. Banks may also impose their own sub-limits, so it’s worth checking with your bank if you’re planning a large transaction. The good part is you won’t need to tweak your UPI app or do anything extra; banks and payment providers will enable the new limit automatically.

Frequently Asked Questions (FAQs)

Q1. Does the new ₹10 lakh UPI limit apply to all my transactions?

A1. No, this new limit is only for specific payments: applying for IPOs, buying securities, and paying credit card bills that are over ₹1 lakh. The limit for most other daily transactions remains ₹1 lakh.

Q2. What was the previous UPI limit for these transactions?

A2. The previous limit for IPO applications and security purchases via UPI was ₹5 lakh per transaction.

Q3. When can I start making payments up to ₹10 lakh using UPI?

A3. The new ₹10 lakh transaction limit will be active from September 15, 2025.

Q4. Why did the NPCI and RBI increase this limit?

A4. The limit was increased to make it easier for people to make high-value investments and bill payments digitally, promoting the use of UPI for a wider range of financial activities.

Q5. Do I need to do anything to activate the new ₹10 lakh limit?

A5. No, you don’t need to do anything. The change will be automatically implemented by banks and UPI apps like Google Pay, PhonePe, and Paytm.