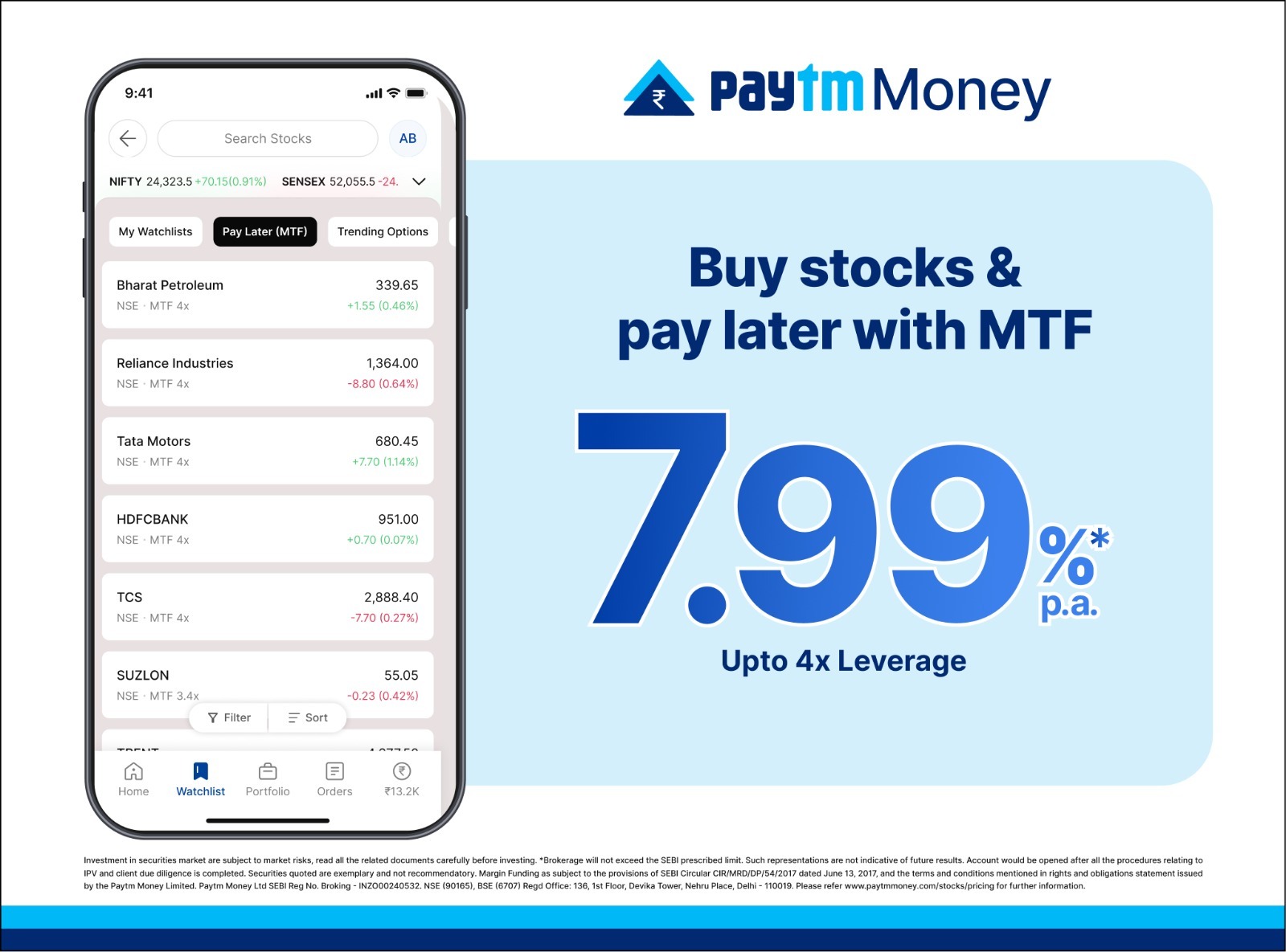

Paytm Money, the wealth-tech arm of One97 Communications Limited (OCL), has announced a major reduction in its Margin Trading Facility (MTF) interest rates—also known as Pay Later. The new structure brings rates down to as low as 7.99% per year, a sharp drop from the previous highs of up to 14.99%. The change is clearly designed to make leveraged trading more accessible, particularly for small investors who often face steep borrowing costs.

Key Takeaways

- Up to ₹1 lakh funding: 7.99% per year

- ₹1 lakh to ₹1 crore: 9.99% per year

- Above ₹1 crore: 8.99% per year (for ultra-high-net-worth investors)

- Previous rates: As high as 14.99%

- Result: Lower borrowing costs and better affordability for smaller traders

What Margin Trading Facility (MTF) Actually Means

MTF is a SEBI-regulated feature that lets investors buy stocks for delivery by paying only part of the total cost upfront—the margin—while the broker covers the rest as a short-term loan. The idea is to use leverage: you get to invest more than your available cash would normally allow, though you do pay interest on the borrowed portion.

So, for instance, if you want to buy ₹1,00,000 worth of shares but only have ₹30,000, Paytm Money can fund the remaining ₹70,000. You hold the shares, but you’ll owe interest until you repay the borrowed amount.

Details of the Revised Structure

Under this new rate plan, Paytm Money has introduced three slabs that cater to different types of investors.

- Small investors, borrowing up to ₹1 lakh, will now enjoy the lowest rate at 7.99% annually.

- Most investors, typically borrowing between ₹1 lakh and ₹1 crore, will pay 9.99%, a notable reduction from the earlier 14.99% applicable to certain brackets.

- High-net-worth investors (HNIs), borrowing over ₹1 crore, can now access a special 8.99% rate, aimed at encouraging larger trades and portfolio diversification.

The company says this structure cuts borrowing costs by over one-third for many users. To visualize this, borrowing ₹1,00,000 for a year at 7.99% interest means paying just ₹7,990 in annual interest. Compared to the previous rates—and even against competitors charging 10.5% to 18%—this is a significant saving.

Why This Matters

For active traders, even a small reduction in funding cost can make a visible difference in overall returns. Paytm Money claims the new 7.99% rate is roughly 45% lower than the prevalent industry average, allowing investors to retain more profit from every trade.

A company spokesperson noted that the rate cut, alongside features like fast order pads and MTF calculators, is part of Paytm Money’s effort to make trading “simpler, clearer, and more cost-effective.” The emphasis, they added, is on empowering users to make better decisions and maximize their take-home gains.

Bigger Picture

In a market where competition among online brokers is heating up, this move by Paytm Money feels strategic. By lowering MTF rates, the company isn’t just undercutting rivals—it’s appealing to both casual traders and serious investors who might otherwise be wary of leverage due to high interest charges.

Perhaps the real takeaway is that the cost of participating in the stock market—especially for smaller investors—is slowly becoming less intimidating. And while margin trading still carries risk, cheaper borrowing rates can make it a more manageable tool in the hands of informed traders.

Related FAQs

What is Margin Trading Facility (MTF)?

It’s a loan facility from a broker that allows you to buy stocks by paying only a fraction of the total price. The broker funds the rest, and you pay interest on that borrowed amount. It’s mainly used for delivery trades, meaning you hold the shares beyond the same trading day.

What are Paytm Money’s new MTF rates?

- 7.99% per year for funding up to ₹1 lakh

- 9.99% per year for funding between ₹1 lakh and ₹1 crore

- 8.99% per year for funding above ₹1 crore

How much did Paytm Money charge earlier?

Earlier, MTF rates were higher, peaking at 14.99% per year for certain funding brackets like ₹1 lakh to ₹25 lakh.

How does the 7.99% rate compare to other brokers?

It’s quite competitive. Paytm Money says this is about 45% lower than industry averages, where most brokers typically charge between 10.5% and 18% per year.

Who qualifies for the 8.99% rate?

That rate is reserved for ultra-high-net-worth investors—clients borrowing over ₹1 crore through the MTF facility.