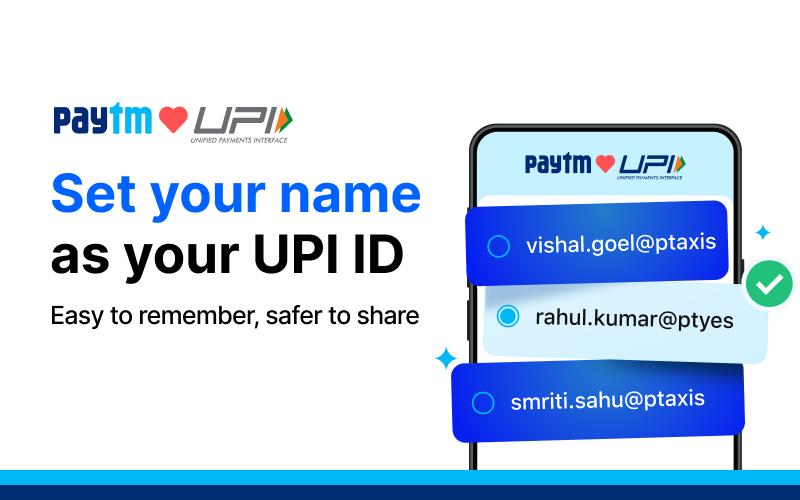

Digital payments in India just got a meaningful privacy boost. Paytm (One97 Communications Limited), a major player in the mobile payments space, has introduced personalized UPI IDs—a small but impactful change. With custom handles like “name@ptyes” or “name@ptaxis,” users can now send and receive money without having to reveal their mobile numbers. It’s a move that’s clearly geared toward enhancing privacy while also making UPI feel a bit more personal.

Key Takeaways:

- Paytm now offers personalized UPI IDs such as name@ptyes and name@ptaxis.

- These IDs allow users to keep their mobile numbers private during transactions.

- Available initially through Yes Bank and Axis Bank, with broader support coming soon.

- It helps maintain privacy in everyday transactions with vendors, delivery agents, or shopkeepers.

- Creating one is easy through the Paytm app’s UPI Settings.

- Seven other features have also been introduced—ranging from payment hiding to global UPI use.

For a long time, the ease of UPI came with an unavoidable caveat: sharing your mobile number with each transaction. While this was just part of how the system worked, it raised a few eyebrows among users concerned about personal data exposure. With personalized UPI IDs, Paytm is addressing that head-on. By letting users create a custom payment handle, it introduces a subtle yet significant layer of anonymity. Now, your phone number stays tucked away.

The Power of a Personalized Handle

Think about paying a street vendor or ordering something from a new online shop. Typically, your number would show up in the transaction history. With a personalized UPI ID like “rajesh@ptyes,” that bit of personal info remains unseen. It’s a seemingly small shift, but for many, it adds a welcome layer of comfort and control—especially when dealing with new or unfamiliar people.

At present, this feature is available for Paytm UPI handles linked to Yes Bank and Axis Bank. A spokesperson from Paytm mentioned plans to expand the feature to other banks soon, suggesting a deliberate rollout that takes into account both technical integration and user feedback.

“We introduced personalized UPI IDs to offer more choice and privacy in payments,” a Paytm spokesperson shared. “We heard the feedback from our customers who wanted to keep their mobile numbers private and built this solution to address that need. We remain committed to developing thoughtful solutions that make payments safer and more convenient for all.” It’s a pretty direct reflection of how user-centric Paytm’s design philosophy has become.

How to Secure Your Personalized UPI ID

Getting started with your own personalized UPI ID is refreshingly simple. Here’s how:

- Open the Paytm app.

- Tap your profile icon (top left corner).

- Go to ‘UPI Settings.’

- Choose ‘Manage UPI ID.’

- Pick from the suggested IDs or create one yourself.

- Confirm it and set it as your primary UPI ID.

That’s it. The whole process is quick, which lowers the barrier to adoption and helps ensure more users can take advantage of the new privacy options.

Beyond Personalized IDs: Paytm’s Broader Push for Smarter Payments

This isn’t just about one feature. Paytm is clearly on a mission to refine the entire digital payment experience. Alongside personalized UPI IDs, they’ve introduced several other tools to boost privacy, utility, and ease-of-use. Highlights include:

- Payment Hiding: Selectively hide transactions to keep sensitive details out of plain sight.

- Automatic Expense Categorization: Let the app sort your spending automatically and present a monthly summary—super handy for budgeting.

- Receive Money Widget: One-tap access to check incoming payments right from your home screen.

- Scan and Pay Widget: A shortcut to speed up QR-based transactions.

- Auto Top-Up for Paytm UPI Lite: For seamless small-value payments (up to Rs. 5000), this auto top-up prevents failed transactions.

- UPI Statement Downloads: Need to review your finances? You can now download UPI transaction data in PDF or Excel.

- Consolidated Balance View: Get a total snapshot of your UPI-linked accounts in one place—no more mental math.

Global Reach: Taking UPI International

There’s more. Paytm is also playing a role in taking UPI global. Indian users can now make UPI payments in countries like the UAE, Singapore, France, Mauritius, Bhutan, Sri Lanka, and Nepal. This opens up a world of convenience for frequent travelers, and helps cement UPI’s reputation as not just a domestic solution but an international one.

All in all, the introduction of personalized UPI IDs feels like a smart, timely update that balances the ease of digital payments with the growing need for personal privacy. As UPI continues to shape how we handle everyday transactions, features like this will likely become essential. Paytm’s latest updates—small in appearance, but meaningful in function—show they’re still very much in tune with their user base and the broader digital landscape in India.