Paytm Money, a well-known wealth-tech platform and a wholly-owned subsidiary of One97 Communications Limited (OCL), has just launched a new lineup of advanced trading tools—clearly aiming to give retail Futures & Options (F&O) traders in India a much-needed edge. This move arrives at a time when retail participation in the F&O space is booming, thanks to increased access to platforms and a growing appetite for more sophisticated trading techniques. The new features are meant to simplify the maze of derivatives trading, deliver timely insights, and help traders—from first-timers to seasoned pros—make sharper decisions.

- Key Takeaways:

- Simplifying the Complex: A Deep Dive into Paytm Money’s New F&O Arsenal

- Options Scalper: Precision and Speed for Short-Term Gains

- Trade from Charts: Intuitive Execution for Technical Traders

- Basket Orders from Option Chain: Streamlining Complex Strategies

- Trading Ideas: Expert Insights at No Extra Cost

- Pay Later at 9.75% for Active Traders: Enhancing Buying Power

- The Bigger Picture: Paytm Money’s Vision for India’s Retail F&O Market

Key Takeaways:

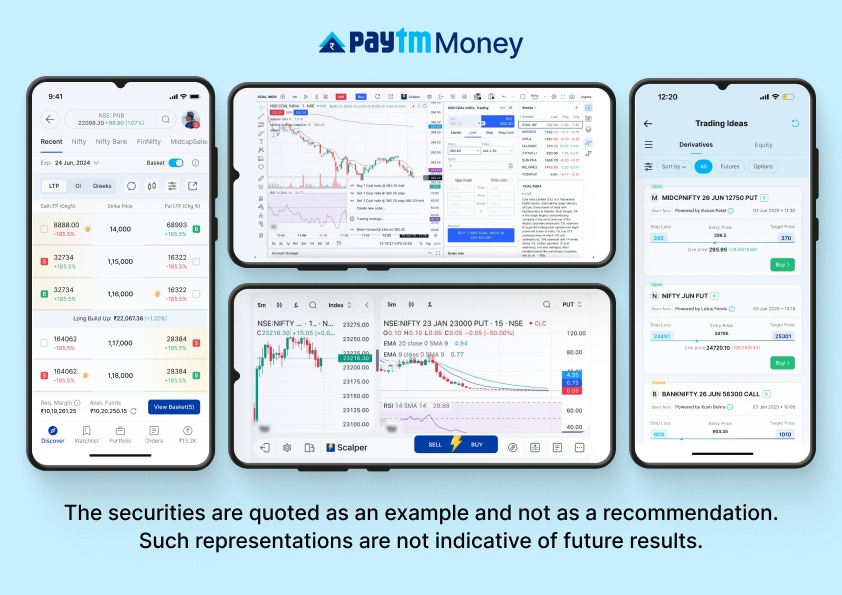

- Paytm Money rolls out new F&O tools: Options Scalper, Trade from Charts (powered by ChartIQ), Basket Orders from Option Chain, and Trading Ideas.

- Margin Trading Facility (MTF), dubbed “Pay Later,” starts at a competitive 9.75% interest rate.

- Options Scalper enables quick execution of complex option strategies with a split-screen view showing charts and underlying assets.

- Trade from Charts offers seamless order placement directly from interactive charts.

- Basket Orders simplify multi-leg option strategies, letting users create and save customized trade baskets.

- Trading Ideas feature provides expert-curated setups and market perspectives from SEBI-registered analysts.

- All features are accessible on the updated Paytm Money app for Android and iOS, post F&O activation and necessary risk acknowledgments.

Simplifying the Complex: A Deep Dive into Paytm Money’s New F&O Arsenal

Retail participation in India’s financial markets—especially in Futures & Options—has taken off in recent years. While this opens up new possibilities, it also introduces a host of challenges, especially for those navigating the lightning-fast world of derivatives. Paytm Money’s latest update feels like a direct response to those pain points. Their approach remains unmistakably tech-first, and the newly added tools reflect that philosophy—geared toward making equity and wealth management not just smarter, but also simpler.

Before getting into the nitty-gritty of these new tools, let’s briefly revisit what F&O trading actually entails. Futures and Options are derivatives—contracts whose value is tied to an underlying asset like stocks, commodities, or indices. They let traders speculate on price movements or hedge existing positions. But the high leverage in these instruments can swing both ways, often dramatically. That double-edged nature is part of what makes them popular—and risky—especially for retail traders. SEBI, the market regulator in India, keeps a close watch here, and Paytm Money’s status as a SEBI-registered Research Analyst for its Trading Ideas is a reassuring nod to its commitment to transparency and investor protection.

Options Scalper: Precision and Speed for Short-Term Gains

Among the more eye-catching additions is the “Options Scalper”—a tool purpose-built for traders looking to profit from rapid price moves in the options space. Scalping isn’t new; it’s a time-tested strategy involving lots of trades to cash in on small price shifts. What’s new is how the Options Scalper simplifies this: it features a smart split-screen layout that lets you view the options chart and the underlying asset side by side. It’s surprisingly handy.

The speed here is a game-changer. You can set defaults for order size and type, and then execute with a single tap. That kind of responsiveness matters when seconds can mean the difference between a gain and a miss. The tool also flags trending contracts using markers like Open Interest (OI), Volume, and At-The-Money (ATM) strikes—all baked right into the interface. For traders, that’s not just data; it’s direction.

Trade from Charts: Intuitive Execution for Technical Traders

For the technically inclined, “Trade from Charts” is likely to resonate. Integrated with ChartIQ—an industry staple for advanced charting—this feature streamlines the entire trade setup. You don’t have to jump between screens anymore. You just spot a pattern, drag a slider to your price target, and boom—order placed.

Whether you’re trading intraday or holding positions overnight, the flexibility here supports both approaches. It’s a small shift in experience, but a big leap in usability for those who rely on charts to make their moves.

Basket Orders from Option Chain: Streamlining Complex Strategies

Multi-leg strategies like straddles, spreads, or iron condors can be powerful—but setting them up has historically been clunky. Paytm Money’s “Basket Orders from Option Chain” takes the grunt work out of that. Now, you can simply click on strike prices in the option chain and build a custom basket—no spreadsheet gymnastics required.

And if you’re running the same strategies often? You can save your baskets for reuse. That kind of repeatability is something seasoned traders will appreciate. It cuts down on execution time and lowers the chance of slip-ups in fast-moving markets.

Trading Ideas: Expert Insights at No Extra Cost

Having access to solid research can be the difference between a shot in the dark and a well-timed trade. Paytm Money’s “Trading Ideas” bridges that gap. It delivers free, curated setups and market insights from analysts registered with SEBI. That’s a big deal—because it means the content is vetted, structured, and held to a regulatory standard.

Not everyone has the bandwidth to comb through technical charts or macroeconomic data every day. For those who want a head start without diving deep into research, this feature can be a real timesaver.

Pay Later at 9.75% for Active Traders: Enhancing Buying Power

On the financing front, the newly launched “Pay Later” (or Margin Trading Facility) comes with an interest rate that starts at 9.75%, which is among the lowest in the space. For traders who want to amplify their positions but don’t want to tie up too much capital, this is worth a closer look.

More buying power at a lower cost means greater tactical flexibility—something active traders are always hunting for. By lowering the financial barrier, Paytm Money is clearly signaling that it wants to support more ambitious trading strategies, without penalizing users with steep borrowing costs.

The Bigger Picture: Paytm Money’s Vision for India’s Retail F&O Market

According to a Paytm Money spokesperson, the company’s “mission has always been to empower every investor and trader with the best tools, insights, and technology.” And honestly, this latest rollout walks that talk. With tools that feel designed around actual trader needs—not just feature checklists—the platform is upping its game.

As more retail traders explore F&O, driven by accessible tech and evolving strategies, Paytm Money seems ready to play a key role in shaping that journey. This mix of intelligent tools, affordable financing, and expert guidance doesn’t just level the playing field—it redefines it. The platform isn’t just chasing trends; it’s trying to lead them.

These features are live now and available on the latest Android and iOS versions of the Paytm Money app. Once users complete the F&O activation and acknowledge the associated risk disclosures, they’re good to go. All in all, it feels like a solid step toward a smarter, more empowered trading ecosystem for India’s growing retail investor base.

Frequently Asked Questions (FAQs)

Q1: What exactly is Futures & Options (F&O) trading, and why is it popular in India?

A1: Futures & Options (F&O) are derivatives that derive value from underlying assets like stocks or indices. They enable speculation or risk hedging. In India, their appeal lies in the potential for high returns via leverage.

Q2: What is “Options Scalper” and how does it benefit traders?

A2: Options Scalper is a new Paytm Money tool that streamlines multi-leg option trades. With a split-screen interface and pre-set orders, it allows fast execution and highlights trending contracts.

Q3: How does “Trade from Charts” simplify the trading process?

A3: Powered by ChartIQ, it lets users place orders directly from charts using a drag-to-price slider. This saves time and suits both intraday and delivery strategies.

Q4: Can I place complex, multi-leg option strategies easily with Paytm Money’s new features?

A4: Yes. With Basket Orders from Option Chain, traders can select multiple strikes, form custom baskets, and save them for reuse, making complex trades quicker and less error-prone.

Q5: Are the “Trading Ideas” on Paytm Money reliable, and what is the cost?

A5: The ideas are provided by SEBI-registered analysts and are free for all users. That regulatory backing adds reliability to the insights.

Q6: What is Paytm Money’s “Pay Later” feature, and what is its interest rate?

A6: “Pay Later” is a Margin Trading Facility allowing users to borrow at a starting rate of 9.75%. It boosts buying power without high interest costs.

Q7: How can I access these new F&O trading tools on Paytm Money?

A7: Update to the latest version of the app on Android or iOS, complete the F&O activation process, and acknowledge the risk disclosures. Then navigate to the F&O section to explore the tools.